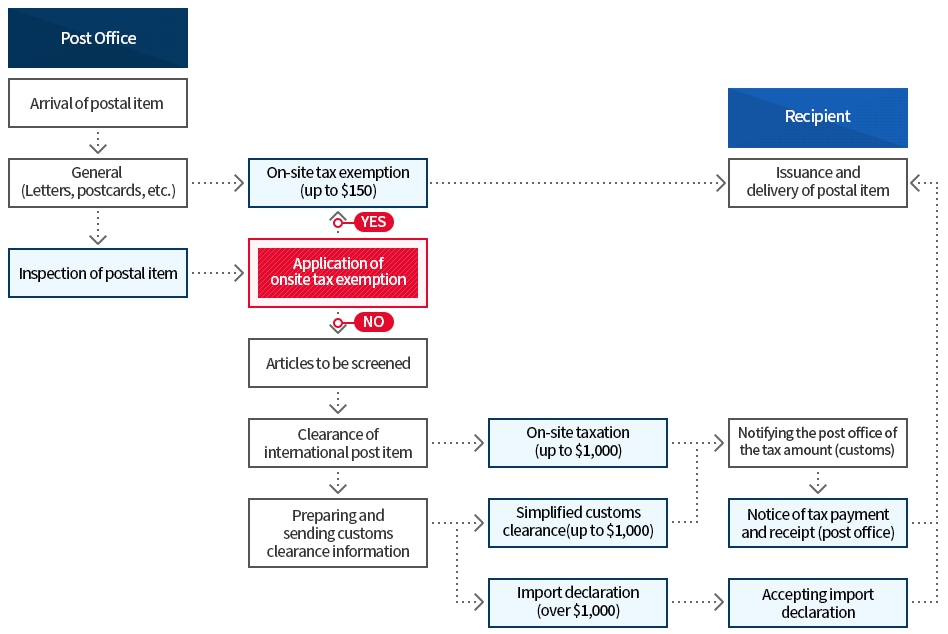

Customs clearance is the process of taking goods through the customs authority on their way into a country (import) and outside the country (export). Today, we will stop at the import clearance since it is one of the most important and complicated issues when it comes to ordering online from other countries.

In some countries, duty and tax may account for almost half of the cost of the ordered product(s). For example, in Palau, Iran, Bahamas, etc. Furthermore, if you don’t follow the regulations or are late to submit any papers, additional charges (storage fee, a penalty from the customs office, etc.) may occur. Thus, it’s useful to check in advance regarding duty & tax amount and which papers you would need to submit.

Sign up & Receive 2 DK Points

Become a member of Delivered Korea & save on your next international shipment!

Sign Up

What Determines Who Will Pay Duty and Tax?

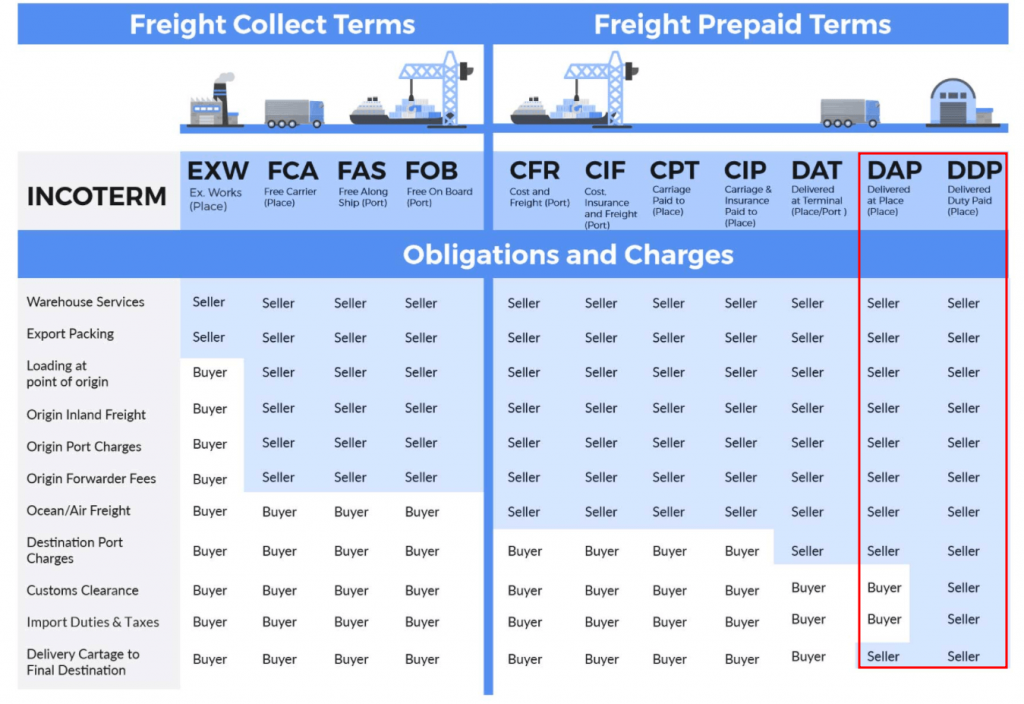

All international orders are subject to customs and duty fees as defined by the country of import. Customs and duty fees can or not be included in the order/shipping total. Who will pay duty & tax is determined by the applied Incoterms (i.e., international commercial terms). You can read more regarding the Incoterms on the ICC (International Chamber of Commerce) website.

In the case of B2C shipping, there are normally DDP and DAP (DDU) terms. As you can see they apply in the case of door-to-door delivery and the only difference is in who is responsible for customs clearance and pays duty and tax (if any apply). In short:

- In the case of DDP, a shipper pays.

- In the case of DAP (DDU), a consignee pays.

What Do I Need to Know About My Purchase to Check the Duty & Tax?

HS Code

HS Code (i.e., Harmonized System Code) is an internationally standardized system of names and numbers that are used to classify products.

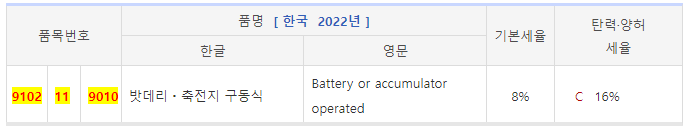

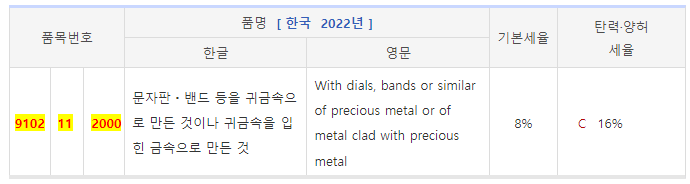

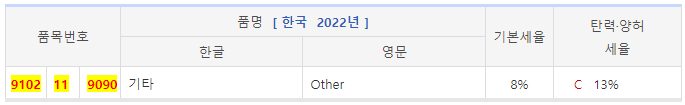

Let’s say you’d like to import watches into Korea. Based on what kind of watch these are, three different HS Codes may apply.

9102,11-9010 – Battery or accumulator operated watches

9102.11-2000 – With dials, bands or similar of precious metal or of metal clad with precious metal

9102.11-9090 – Other

Country of Origin

Country of origin (CO) is a country or countries where manufacturing, production, extraction, design, or brand origin of an article or product took place. It is different from a country of capital investment, a country providing technology, or a country owning a trademark.

A Certificate of Origin (CO) is used to prove the country of origin. It is an important international trade document that declares the “nationality” of a product or an article.

According to the International Chamber of Commerce (ICC), almost every country in the world requires a Certificate of Origin for customs clearance procedures: when determining the duty that will be assessed on the goods or, in some cases, whether the goods may be legally imported at all.

There are two types of COs that chambers can issue:

Non-Preferential COs which certify that the goods are subject to no preferential treatment. These are the main type of COs that chambers can issue and are also known as “Normal COs”.

Preferential COs, which certify that goods are subject to reduced tariffs or exemptions when they are exported to countries extending these privileges. These COs tend to be closely associated with Regional Trade Agreement.

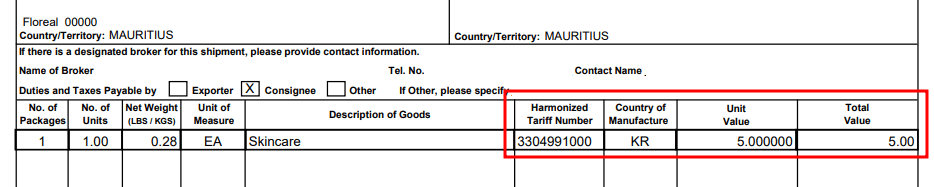

Declared Value

Declared value is the value of the goods declared for clearance. It is used to determine the amount of duty and tax to be paid on imported goods. At the same time, it is also the amount a shipper stated to the carrier that a particular shipment is worth. It appears on the Commercial invoice (CI).

Which Regulations Should I Put Attention to?

Import, export or return of goods happens pursuant to the procedures prescribed by the Customs Act of a particular country. It covers tariffs and other measures that are used to regulate the flow of goods into and out of a country. Thus, the best way to get the most exact information is to contact your local customs.

Agreements (WTO, FTA, etc.)

If you have a certificate of origin and exemption rules in an agreement apply in your product(s) case (based on a particular US Code), the duty amount will be reduced or eliminated.

Duty-free limit for imports

You should also check other requirements for the importation of products into your country with the local customs office and the seller. For example, to import glasses into the USA, you would need a drop ball test certification. To import products in India, KYC documents should be submitted, and the consignee’s information must match those in the documents.

Shop Trending Korean Products

Sign up with DKshop & get access to thousands of K-pop merch and more!

Shop Now

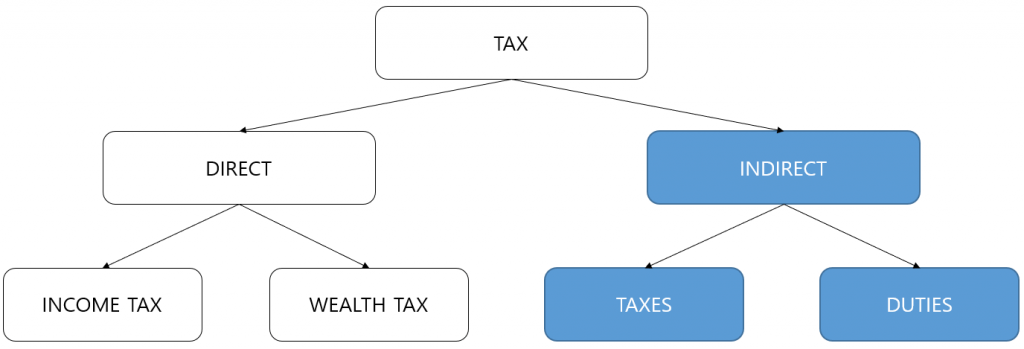

Duties and Taxes – Similar But Not the Same

Both duties and taxes constitute the total amount one must pay on import of a product.

Indirect Taxes

Indirect taxes are placed on almost all purchases. Usually, when we talk about tax in the context of import, we mean VAT (value-added tax) / GMT (Goods and Services Tax). However, please note that not all countries have them. For example, as of 2021, such countries include the USA, Iraq, Qatar, Brunei, etc. Some countries, like Belize, instead came up with some kind of alternative tax. In the case of Belize, such is a General Sales Tax introduced in January 2006.

In Korea, VAT is 10%. Thus, if the declared value exceeds the KRW150,000 (~US$150)* duty-free limit, 10% of the declared value amount will be charged either to the consignee (if the parcel is shipped under DAP/DDU terms) or to a shipper (if a parcel is shipped under DDP terms).

*As of February 2022

Duties

Duties are charged on goods entering or leaving a country; include custom duty or excise duty.

In short, tax is a wider term; duty is a subtype of tax.

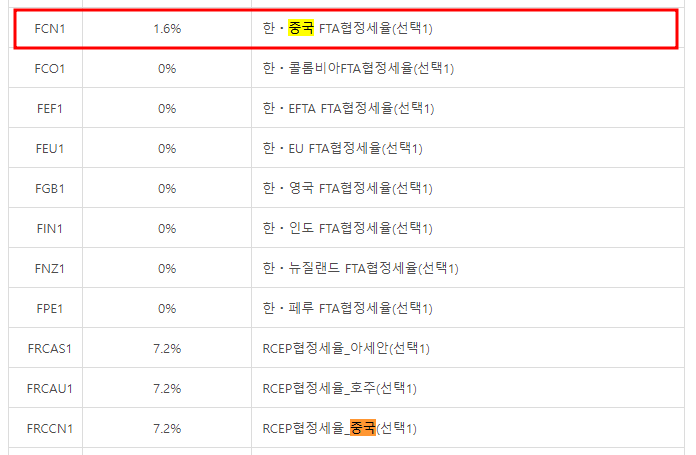

Here is an example based on the information given on the Korean Customs Law Information Portal. Going back to our example with watches, let’s consider that their country of origin is China. If we check in detail, we can see that there are several agreements, including the Korea-China Free Trade Agreement that is applicable to this HS Code.

9102.11-9010: We choose the smallest value which is 1.6%. It means that if you decide to import battery or accumulator-operated watches into Korea, you would have to pay 1.6% of the declared value as a duty.

한-중국 FTA 협정세율(선택 1) => 1.6%

9102.11-2000 and 9102.11-9090: We can see that for these HS Codes both in the case of the Korea-China Free Trade Agreement and the Regional Comprehensive Economic Partnership duty is 0%.

한-중국 FTA 협정세율 (선택 1) => 0%

RCEP 협정세율_중국(선택 1) => 0%

Note! For these rules to apply a Certificate or Origin should be provided to customs.

Tariffs

Tariffs, unlike duties, are direct taxes imposed on products or articles imported into a country. They may be levied for many reasons. One of which is to discourage the import of a specific product by adding to the cost of a product, which in turn, discourages people from purchasing it. It’s done to safeguard domestic manufacturers.

On top of duty and tax, brokerage services fees are usually paid either to the carrier’s in-house broker or a local broker.